Bitcoin, like other constants in the universe, creates a foundation upon which humanity can interpret monetary information and chaos.

This is an opinion editorial by Aleks Svetski, author of “The UnCommunist Manifesto,” founder of The Bitcoin Times and Host of the “Wake Up Podcast with Svetski.”

If life could be described as some form of anti-entropic force, then humans could be regarded as the most advanced, complex structure that has emerged from it (at least that we’re certain of).

This force of “life” seems to transform chaos into order. It manifests as the very edge line of this universal substance we call energy and like “energetic fingertips,” it reaches for greater order. In this sense, we are the very fingertips of life.

It’s an extraordinary thing to think about.

I know I risk getting a little “woo-woo” here with all the energy talk, but I do mean it seriously and in the physics-like sense of the word.

We are composed of matter, which exists in a particular order. Throughout our lifetimes, we consume and transform energy, move in temporal and spatial directions of all kinds and do our best to locally defy entropy before passing the torch onto the next incarnation of life to do the same.

Why? Unfortunately, this I cannot answer for you. It’s my belief that we must answer that question for ourselves individually.

My closest approximation is that we’re part of a cosmic balance between entropy and life. You could call it light and dark, Yin and Yang, positive and negative, or heaven and hell; but do note that both will co-exist. Forever.

As humans, we represent, on net, the life side of the equation. So whether we like it or not, we all possess some internal, intelligent volition to build, order, create, produce and, in some way, defy entropy.

Whether you’d like to call this volition to order “God,” “life,” “consciousness,” “randomness” or “intelligence,” it matters not. You cannot deny its existence and if you stop for a moment, you cannot help but marvel at its defiance.

So why am I talking about this?

Art And Science

In The UnCommunist Manifesto, Mark Moss and I argued that capitalism is not a “political modality” but an organic process that all complex living species undertake.

In this sense, economics is the study of capitalism. It’s an attempt to try and understand this process, measure it and use the data to make better value judgements and decisions in the future.

John Carvalho calls it “a game.” I call it life.

The goal of the game is to economize. To economize is to literally maximize the efficient and effective use of scarce resources to a particular end; survive or thrive.

Humans happen to be the most adept at this game, hence why we are the apex species.

Engineering As A “Pursuit Of The Divine”

We engineer to economize.

Michael Saylor argues that humans are engineers by nature. I wholeheartedly agree. It’s in our DNA. Being the highest incarnations of life, we operate as vehicles for this same progressive, transformational force.

We’re like that nexus point between chaos and order, consistently using a combination of analysis and imagination to produce something new.

We’re a blend of art and science. Incredibly designed, emergent, biological and spiritual machinery that is simultaneously unique (there is nobody like you) and similar (we are all alike).

As engineers and artists, we’ve managed to architect the world around us using a blend of math and intuition. We use games to sharpen our skills and value-judgment processes in order to play better at the grander game of life.

Each accurate intuitive leap has taken us to a new threshold of understanding, which in turn enables the conversion of our environment into a new static, higher-order pattern that is reproducible.

This upward-ratcheting standardization — so long as it is not based on fairy tales, but rooted in reality — becomes a foundation upon which to build greater and greater social and physical monuments.

Functional standards come in two forms:

- Those which have lasted the longest time. They are known as lindy-compatible, because the longer they’ve lasted, the longer they tend to last.

- Those which are empirically, energetically or mathematically sound.

Number one and number two are often the same, but not in every case. Some standards are a little more arbitrary, for example: the QWERTY keyboard, the width of a railway gauge or 21 million bitcoin. So long as its arbitrary nature is not incongruent with some physical law, then it’s fine.

In other words, the width of the chariot axle could’ve been a little more or a little less than 4 foot and 8.5 inches and it wouldn’t have made a difference. That alternative measurement would then have been the standard we used for railway gauges and so forth. What matters is that a consensus forms over time and becomes the standard.

The same goes for Bitcoin. I’m not sure we’ll ever know why 21 was the number. Maybe there is some hidden meaning (half of the answer to the ultimate question?), maybe not. Either way, the importance lies in the fact that it is a fixed and verifiable standard.

The genesis of this standard occurred in 2009 and 13 years later, it’s not just still there, but is exponentially more sound socially, economically and thermodynamically.

This is an extraordinary feat and a foundation we can build upon.

It is engineering at its finest.

Playing Pretend Leads To Poverty

Problems arise when functional standards are ignored or when arbitrary standards are simply decreed, with no regard to the conservation of energy or the natural order of things.

“You cannot pretend your way into prosperity”

Politicians spend their entire lives playing the worst kind of pretend; they do so with everyone else’s resources.

Therefore instead of impoverishing themselves, which would be the case in a free market, they impoverish all of us. Worse yet, by virtue of the political apparatus, they actually enrich themselves in the process!

There’s something deeply wrong with this.

But I ask you. Is it entirely their fault? Of course each individual is responsible for their actions and in time shall be held accountable, but in a world where power, economic force and macro decision making is so concentrated, does it not make sense that such actors believe that they can will their way into fixing everything?

They’ve surely drunk their own Kool-Aid and, sitting atop their perch in Davos, Brussels or D.C., they see the problems of the world as a lack of their supervision and involvement.

“If only they could direct us all better.” If only they, like The Almighty, decreed it so, then all the problems shall be gone.

Unfortunately, reality doesn’t work like this and every time we go down that path, every time we play along and pretend our way toward empty promises of prosperity, every time we build atop a lie or a false premise, our structures have come crashing down.

The time has come to change this. The point of maximum leverage in the modern age is the money.

Engineered Energy Money

The one area where we’ve never had a perfect standard — and it’s about time that we do — is the money. Humans, being social, and money, being the most important social invention of all, makes it critical for us to engineer a standard that is closely representative of that which it measures.

In order for us to advance as a species, this is a necessity.

Vaclav Smil calls energy the “Universal Currency.”

I would argue, as would Saylor and many others who intuitively and viscerally understand it, that bitcoin is “Energy Money,” and thus a perfect Universal Currency for use on Earth.

We’ve had the zero-to-one moment for this invention. All that came before was a necessary experiment. All that will come after shall be structures built atop this bedrock discovery/invention.

I call it that because it is both. As a species, we had to discover energy money. It is a crucial part of a sentient species’ pathway through the Great Filter.

Bitcoin is humanity’s version and, although we invented it, it was something we had to discover, like electricity, the internet or the speed of light. It lives in those realms. It is the first “information-element,” as Knut Svanholm would call it.

The convex nature of what comes next is unlike anything we have seen before.

“The money” is the sacred ledger-in-the-sky that accounts for all energy, action, time and resources. It’s the ultimate scorecard and is not just important for a society to function, but is the keystone. If that is compromised, the entire structure fails.

Achieving practical perfection of such a deep (if not the deepest) layer of the societal stack, has far reaching consequences, farther than any eye can see or mind could imagine. It shifts the very course of humanity — something I do not say lightly.

The speed of light changed everything for physics and engineering alike.

As the “engineers of life,” working within the overlapping realms of the physical, economic and social, we’ve not had a tool like bitcoin, ever. The alchemists were in search of it for hundreds of years, long before it was a technical possibility.

They laid the philosophical groundwork for what it would be and what it would represent.

“There abides in nature a certain pure matter which, being discovered and brought by art to perfection, converts to itself all imperfect bodies that it touches.” — Aron Villanova, alchemist from the 13th century

John Vallis discusses this in much greater detail in his magnificent piece, “Money Messiah.”

Now that we have this substance, everything changes.

Physics is how we discover universal scientific truths that we can apply to engineering.

Economics is how we examine action, incentives and what matters in order to make value judgments and decisions.

With bitcoin we have something that bridges the gap between the metaphysical nature of money and its physical, energetically-conservative reality.

Bitcoin is economics meets physics.

As such, we can apply a physics-like approach to engineering civilization locally, within a framework of value that has true consequences and delivers accurate feedback.

For the first time in human history, we have real money.

I know I sound like a raving lunatic, but this is absolutely monumental in the grand scheme of things.

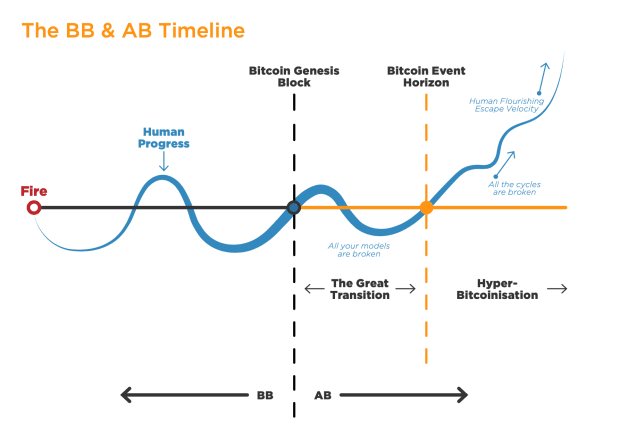

I refer to a chart from the “Fire, Bitcoin, Teleportation” piece I wrote for The Bitcoin Times last year:

Before all the pessimistic keyboard warriors come out in force to denounce my utopianism, what I am saying does not presuppose some unicorn-laden utopia where we’re all just “happy and peaceful” all the time.

We’ll have just as many problems, but they will be better, higher quality problems.

And this may in fact be where the true definition of evolution exists, at least in a social, “intelligent” or “consciousness” sense. What we are striving for is not the elimination of problems (that’s a load of Marxist garbage), but the enhancement of the quality of our problems.

Akin to the force of life I described earlier, we seek to reach further or, perhaps better stated: life seeks to reach further through us. As I said, we are but a vehicle, the very fingertips of life.

Monetary (B) And Physical (c) Constants

So back to the speed of light, and its relationship to bitcoin.

We have a universal standard that we can now use as the basis of functional civilization-level engineering. I hesitate to use the term “social engineering” because it comes with so many bad connotations, but the truth is, we are always going through a process of engineering our societies. The questions simply are:

- What are we engineering towards?

- What are the tools we’re using?

- How are we approaching the problem?

- Who is involved and who is impacted?

In the absence of good tools and an agile, decentralized market approach, we succumb to the entropy of centralization. Over time, this tendency to centralize across greater scales has and always will form an empire of lies in order to give the illusion of it being held together.

We are living in it today, just as we have in the past. Only this time the lies are more pernicious and their transmission more subtle.

With bitcoin, we finally have a financial constant that we can build an accurate set of financial, cyber and physical infrastructure from.

Not only does it solve the sound money problem but, as a known constant or baseline, it allows all the economists, financial engineers, bankers and anyone else who chooses to do so, to build models that aren’t derived from the ever changing “animal spirits” theorem.

Furthermore, because cost and consequence is made real in cyberspace, it raises the bar for engineering in bits and bytes. This has two follow on benefits:

- It makes software more lifelike, consequential and meaningful. We don’t need another gambling platform or stupid social media app full of bots and censorship. We need real products.

- It pushes innovation back to the world of atoms, because the ease with which one can whip up mindless software to sell to VCs diminishes and talented engineers begin to look elsewhere for problems that need solving.

This application of costs to the world of bits is a fascinating rabbit hole and one I will explore in a future essay. But suffice it to say that the world has fallen far behind in the realm of innovation in atoms. It’s about time we fixed this, not by decree, but via opportunity and localized economic calculus.

The discovery of the speed of light as a constant revolutionized physics and engineering. It impacted measurements and enhanced our view of the universe. For example, we can be very precise with measurements now that the meter is the length of the path traveled by light in a vacuum during a time interval of 1/299792458th of a second.

We all now know that matter (or mass) is related to energy via the “c” constant in the famous E = mc2.

These physical and mathematical constants allow us to build models that can more accurately represent reality, in stark contrast to the modern financial and political sophistry built on numbers people neither understand nor believe are true.

Bitcoin fixes this.

Want to create crazy financial models? Go for it. But remember, there are consequences for being wrong and the system will not bail you out. You will not rupture or compromise anything for the rest of us.

Want to defraud people via some complex financial abstraction? Sure, by all means do so. But don’t be surprised when those with the time and skill to do so call bullshit. When the underlying assumptions are guaranteed, as they are with bitcoin, unfettered Ponzi schemes have a much harder time surviving.

Sunlight, like transparency in the money, is the antidote to mold.

Today, nobody can check or call bullshit on anything unless you’re Kyle Bass with billions to research with, and even then be on the wrong side because some politician decided to change the rules or conjure up some numbers.

You can’t build any form of sophisticated functional system like that. Abstraction atop false assumptions is doomed to fail.

I’ve said it before, one cannot build monuments on poor foundations.

From Bitcoin, Personality And Development.

From Bitcoin, Personality And Development.

In Closing

Much has been created, built and produced in the past 3500 years of human civilization. The last 500 years have brought with it massive technological progress that has further been accelerated with the advent and use of things like steel, oil, electricity and, more recently, the internet.

Matter, energy and information.

The last big thing that awaits — that can and should be: fixed, robust and constant — is the money. And it may well be the most important one of all.

We must transcend the current state.

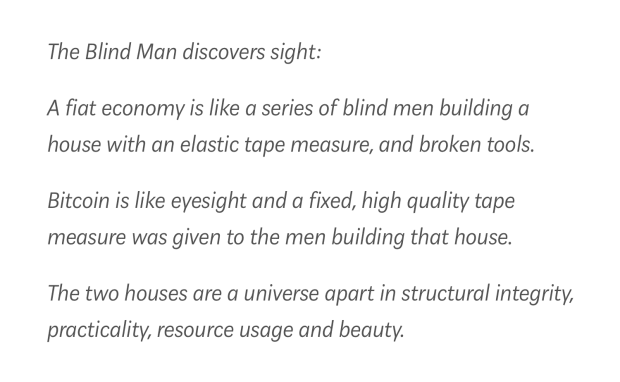

Imagine trying to do physics, let alone any sort of useful modern engineering without constants like “c,” or the laws of thermodynamics. Nothing would work. In fact, imagine using 200 different measurement units for length! That’s the global economy in a nutshell.

The biggest problem we have in the world today is The Money. Nobody actually knows what it is, how much of it there is or what’s actually going on, but we go on building complex models on top of this quicksand, using assumptions and approximations conjured up on a whim.

Central planners try to treat economics like a science, but the key variables are unknown and constantly manipulated with total disregard to the ramifications that tampering has on a complex, dynamic system.

This is where Bitcoin really shines.

A set of very clear rules and constants that are nigh on impossible to change (need very broad agreement), that anybody can verify instantly and voluntarily choose to adopt or not.

It’s a better, more robust foundation upon which to play the economic game.

Same as the internet. It’s a better foundation upon which to build communication and collaboration based technologies. That’s why it won.

Bitcoin has all the key attributes for a more functional, efficient, open and performant economic network. Clear, precise, robust, conservative, Lindy, antifragile, voluntary.

And because of its recursive nature, it’s a runaway train.

Nobody is catching this one.

Last Thing…

It’s ok that you didn’t discover Bitcoin. You didn’t discover the wheel either and I’m sure you’ve used and benefited from it.

There seems to be this hesitance to trust or adopt Bitcoin because Apple, A16Z, Google or the government didn’t create it.

“It was some anonymous guy.”

But that’s the point. Bitcoin is not a company, a government, a security or an app.

Neither Apple, A16Z, Google or the government created oil, gold, water or the internet for that matter. And thankfully not.

These commodities are used by groups of people, companies and/or governments and the internet is an emergent communications network that is made up by all of us.

Bitcoin is like both of these things, rolled into one. Bitcoin is all the nodes; it’s a network not run by anyone, made up of everyone, that functions like something you would find in the ground.

Bitcoin is digital energy.

Bitcoin is digital matter.

Bitcoin is the monetary constant.

Bitcoin is all of these things and more.

This is a guest post by Aleks Svetski, author of “The UnCommunist Manifesto,”, founder of The Bitcoin Times and Host of The Wake Up Podcast. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Related Content

- Bitcoin, Ethereum Technical Analysis: BTC Slips Below Key Support Point as US Markets Reopen Following Labor Day

- Bitcoin Trading Techniques for Consistent Gains

- How to Withdraw Crypto from Crypto.com to Another Wallet or Exchange

- CRYPTO: MAJORITY MAY LOSE OUT!!

- Microstrategy Buys 18,300 More Bitcoins, Boosting Total Holdings to 244,800 BTC