A rise in financial censorship this year, perpetrated by citizens’ own governments and adversarial nations alike, calls for Bitcoin.

This is an opinion editorial by Kudzai Kutukwa, a financial inclusion advocate who was recognized by Fast Company magazine as one of South Africa’s top-20 young entrepreneurs under 30.

“Every record has been destroyed or falsified, every book rewritten, every picture has been repainted, every statue and street building has been renamed, and every date has been altered. And the process is continuing day by day and minute by minute. History has stopped. Nothing exists except an endless present in which the Party is always right.”

At the outbreak of the first world war, Great Britain had the world’s most sophisticated undersea telegraph cable system, which wrapped around the entire world. On August 5, 1914, a day after the British had declared war on the Germans, a British ship, the Alert, set sail from the port of Dover with a mission of cutting off all of Germany’s communications with the world by sabotaging the Germans’ undersea cables and the mission was accomplished successfully.

A day before the Alert set sail, on August 4, a man was deployed to the cable station at Porthcurno in Cornwall and the cables carrying traffic across the Atlantic came ashore on the beach. The job title of this man was “censor” and numerous other censors were deployed across the empire, from Hong Kong to Malta to Singapore. Once the censors were in position, a worldwide system of intercepting communications known as “censorship” was born. Its main aim was to prevent the communication of strategic intelligence between the enemy and their agents. In other words, the goal had evolved from just crippling the Germans’ ability to communicate, to also gathering intelligence.

Over 50,000 messages per day were handled by the network of 180 censors at U.K. offices. By leveraging their dominance over the international telegraph infrastructure, the British created the first global communications surveillance system that stretched from Cape Town to Cairo and from Gibraltar to Zanzibar. This became one of the choke points that led to the defeat of the Germans.

While the phenomenon of censorship is by no means a new one, as highlighted by the historical account above, the fact still stands that it’s a weapon that has been deployed throughout history to silence opposing views, cripple independent thought and ultimately subjugate “enemies of the state” or entire nations.

2022 was in many ways what I would personally call the year of the “censor.” As I look back and reflect on 2022, it seems to me that incidents of censorship are now the rule and not the exception thanks to the rise of cancel culture on social media and various independent media voices offering diverse views on controversial topics that, in some cases, contradict the “official narrative.” Honest and open debate is stifled when these views get censored, resulting in further polarization.

Furthermore the convergence of digital platforms and banking has led to the rise of another, more dangerous and pervasive form of censorship: financial censorship. This is a more malicious form of censorship that isn’t just about hindering or intercepting communications, but is characterized by cutting off one’s access to basic financial services, restricting who one can trade with and hindering the ability to transact freely. This includes but isn’t limited to shutting down the bank accounts of political opponents, being blacklisted and deplatformed by payment processors and economic sanctions. What started out as a tool to stop criminals and other bad actors from financing their nefarious activities has now morphed into a weapon for silencing critics, oppressing dissenters and harassing whistleblowers, as well as indirectly controlling the spending habits of people.

Given Bitcoin’s censorship resistance, it too was also subjected to numerous attacks in this past year as the censors clearly understand that it’s an alternative monetary system that they cannot stop, control or influence.

In a world where the definitions of what constitutes “acceptable speech or appropriate behavior” are constantly moving targets, who knows when you may end up having your bank accounts frozen for having a different perspective or for something you posted on social media ten years ago? Will independent thought result in financial retaliation? In this essay I will highlight a few of the key incidents of financial censorship that occurred in 2022 which were basically free Bitcoin marketing campaigns, and more importantly, discuss how Bitcoin is the perfect shield going forward.

The Freedom Convoy

“The greatest danger to the State is independent intellectual criticism.”

The increased levels of collusion between the State, bankers and big tech against individuals and organizations that hold legal but dissenting views is perhaps the most obfuscated and dangerous form of financial censorship.

The Freedom Convoy protests that kicked off on January 22 by Canadian truckers who were protesting against COVID-19 vaccine mandates clearly demonstrated how third-party payment platforms and banks can collude with the State to financially cut off individuals without due process. Through the crowdfunding site GoFundMe the truckers managed to raise approximately $7.9 million in donations. GoFundMe then withheld and later refunded the donations to the donors citing a violation of their terms of service against the promotion of violence.

Not long after that, Prime Minister Trudeau invoked the Emergencies Act, which allowed the government to freeze the bank accounts, suspend insurance policies and withhold other financial services from the protestors and their donors.

During a press conference on the February 14, after the invocation of the Emergencies Act, Deputy Prime Minister Chrystia Freeland made the following remarks:

“The government is issuing an order with immediate effect, under the Emergencies Act, authorizing Canadian financial institutions to temporarily cease providing financial services where the institution suspects that an account is being used to further the illegal blockades and occupations. This order covers both personal and corporate accounts…As of today, a bank or other financial service provider will be able to immediately freeze or suspend an account without a court order. In doing so, they will be protected against civil liability for actions taken in good faith. Federal government institutions will have a new broad authority to share relevant information with banks and other financial service providers to ensure that we can all work together to put a stop to the funding of these illegal blockades.”

The Canadian government chose to shut down the protests by nuking the protestors’ financial infrastructure. Financial services providers were given the green light to do so without due process and were given legal cover by the state for any blowback that could result from enforcing this decree. Furthermore, the government intends to extend these measures and make them permanent.

Whether one agrees with the truckers or not, it is very obvious that using financial censorship to resolve domestic dissent is a terrible precedent to set.

On the flip side the weaknesses of State-controlled money were exposed in full view for all to see. This incident was the best Bitcoin commercial ever made, as it simultaneously showed the weaknesses of centralized financial platforms while proving the utility of a decentralized currency like bitcoin.

At the stroke of a pen, thousands of people were denied access to their own money and it was all “perfectly legal.” The message was clear; reliance on a centralized financial system that is biased is very risky. By applying pressure on this one choke point, the expression of other freedoms is also curtailed, whether it’s freedom of expression or freedom of movement as they all contingent on one’s ability to transact. One of the truckers described how his personal and business accounts were shut down. The business in question wasn’t connected in any way with trucking, politics, protests or the Freedom Convoy, but its bank account was still shut down by the Canadian government and this has completely crippled the owner’s ability to make a living.

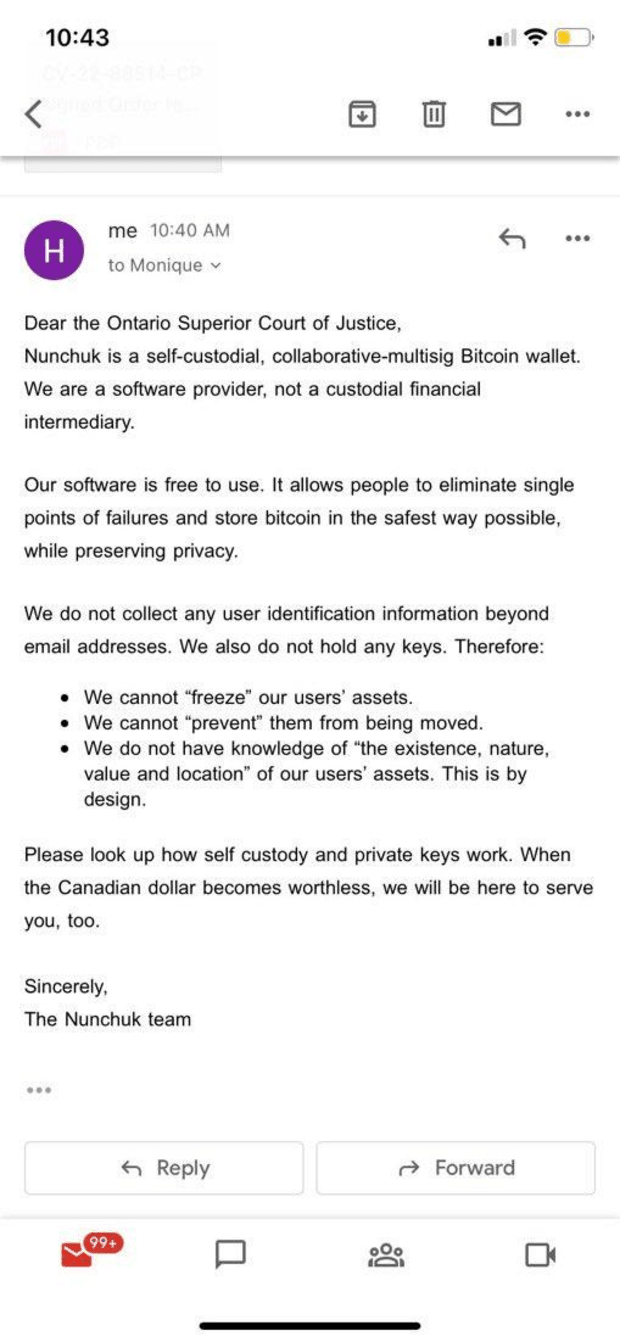

Following the action taken by GoFundMe, a Bitcoin fundraising campaign dubbed “Honk Honk Hodl” was started on Twitter with the intention of raising 21 bitcoin (worth approximately $1,100,000 at the time) for the truckers and they successfully raised more than 14 bitcoin. In response to this, the government extended the ban to include bitcoin and other cryptocurrency donations and pressured cryptocurrency exchanges to freeze the accounts of anyone involved in funding the truckers as well as to share their personal information with the State. The Ontario Superior Court of Justice ordered self-custody wallet provider Nunchuk to disclose user information and freeze Bitcoin wallets of its users in accordance with the government decree. The official response from Nunchuk was as follows:

Once again, Bitcoin’s censorship resistance passed the test, and Nunchuk’s response not only highlights the importance of owning money that cannot be seized or censored, but of self custody as well.

Not to be outdone, the Iranian regime took a page out of the Canadian government’s playbook of using financial censorship as a weapon to crush dissent amongst its citizens when they issued a decree that will enable the state to freeze the bank accounts of women that will not wear a hijab. Protests have been going on in Iran since September 17, when Mahsa Amini, an Iranian woman, was arrested by the morality police for not wearing a hijab and later died under dubious circumstances at a Tehran hospital. The case for Bitcoin, a censorship resistant form of money, has never been stronger.

It’s against this background that I am convinced that central bank digital currencies (CBDCs) are a threat to individual liberty and financial sovereignty as they endow the state with the ability to financially censor anyone, for any reason at the push of a button, without due process. In a CBDC world, a protest such as the Freedom Convoy would probably not have happened. This is why it’s a matter of great concern that nine out of 10 of the world’s central banks are currently actively working on launching their own CBDCs. Furthermore, according to a report released by the Bank for International Settlements in May this year, “the growth of cryptoassets and stablecoins’ is the main reason that the majority of these central banks are actively pursuing CBDCs.

In other words, the censors’ top priority is to neuter Bitcoin and stablecoins since they neither want to lose their power to print money ad infinitum nor to loosen their grip on the scepter of financial censorship.

This explains why the Nigerian central bank issued an edict on December 6, that capped ATM withdrawals at a maximum of $45 a day and $225 a week in a bid to coerce more people to use the eNaira, the country’s CBDC. After experiencing similar financial censorship to the truckers in 2020 during the anti-police brutality “End Sars” protests, Nigerians are definitely not keen on signing up for CBDC induced digital serfdom. As a result adoption of the eNaira has been dismal to say the least, with only 0.5% of the country’s 217 million citizens having used it since its launch in October 2021. The Nigerian central bank’s draconian measures to promote the eNaira by declaring war on cash will just serve to strengthen Bitcoin’s appeal and adoption is likely going to keep rising. Having said that, I wouldn’t be surprised to see in the coming year more measures of this sort being implemented by central banks as they “promote” their CBDCs.

Censorship-Resistant Design

“When we can secure the most important functionality of a financial network by computer science rather than by the traditional accountants, regulators, investigators, police, and lawyers, we go from a system that is manual, local, and of inconsistent security to one that is automated, global, and much more secure.”

Bitcoin is a global, fully-decentralized, trustless, permissionless, non-sovereign and censorship-resistant form of money. It exists beyond the control of the State or any corporation and functions perfectly without the need for coordination by any centralized third parties. Of the many attributes of Bitcoin, censorship resistance remains one of the most unappreciated yet very important in this age of pervasive surveillance and financial censorship.

Censorship resistance is the ability of a currency to be stored and transacted, unhindered and unencumbered. Censorship-resistant money is immune to confiscation, freezing or interception by any third party. Anyone can access Bitcoin because it’s permissionless and, as it scales, it becomes more decentralized and therefore harder to censor.

Valid transactions that are processed on the Bitcoin network are uncensorable and no third party can block them or blacklist a wallet address. Users are protected from asset seizures by the state or freezing by private corporations — in short, it is neutral money that is governed by rules and not rulers. If WikiLeaks had been receiving donations via Bitcoin from day one, the financial blockade it experienced would have meant nothing.

The Bitcoin architecture is by design built to be censorship resistant as this ensures that no arbitrary changes to its monetary policy or to the protocol itself can be made unilaterally, thus guaranteeing the stability and integrity of the network. Without this attribute in place, what would be the guarantee that the maximum supply cap of 21 million bitcoin will not be increased unilaterally in future?

As Parker Lewis aptly puts it, “Censorship resistance reinforces scarcity and scarcity reinforces censorship resistance.” Bitcoin’s absolute scarcity is the foundation for every financial incentive that makes the Bitcoin network functional and valuable; thus, without censorship resistance built in, the entire system is compromised.

Contrast this with the current fiat system and its various payment rails that have terms of service that can be changed at the drop of a hat by a committee or due to pressure from social justice warriors as well as the State. An example that comes to mind would be PayPal’s deplatforming of alternative media sites, Consortium News and Mint Publishing, for publishing stories that were critical of the “official narrative” with regards to Western support of Ukraine. PayPal didn’t stop there, in September of this year, it also simultaneously shut down the accounts of the Free Speech Union and “UsforThemUK” (a parents group opposed to locking down schools during the pandemic) due to the “nature of its activities.” This was done with no prior warning, or clear explanation and it was unable to withdraw the thousands of pounds’ worth of donations that were still in its account.

Other organizations that were added to PayPal’s blacklist this year include: The Daily Sceptic; the U.K. Medical Freedom Alliance; Law Or Fiction, a website that educates citizens on their rights and how they have been affected by the British government’s response to COVID-19; and Moms For Liberty, to name just a few. These organizations will soon realize that the solution to the predicament of financial censorship is the adoption of a Bitcoin standard, where no entity, no matter how powerful, can censor their transactions.

SourceThe Rise Of Financial Restrictions

SourceThe Rise Of Financial Restrictions

“Liberty once lost, is lost forever.”

On August 8, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash (TC), an Ethereum smart contract mixer, and added it to the Specially Designated Nationals (SDN) List. According to OFAC, TC was allegedly used to launder cryptocurrency worth $455 million that was hacked by the North Korean government-backed hacker organization the Lazarus group. According to the Financial Times, a senior, unnamed Treasury official commenting on the sanction of TC said:

“‘We do believe that this action will send a really critical message to the private sector about the risks associated with mixers writ large,’ adding that it was ‘designed to inhibit Tornado Cash or any sort of reconstituted versions of it to continue to operate. Today’s action is the second action by Treasury against a mixer, but it will not be our last.’”

This is clearly a warning that the State intends to continue tightening the screws on financial privacy tools and will not hesitate to blacklist any insufficiently-decentralized protocols. This action by OFAC of sanctioning an open-source protocol sets a precedent that indirectly outlaws financial privacy. This further breeds uncertainty within the open-source community, as developers may be prosecuted for writing code, should it be deployed by criminals later on.

As if on cue, four days after TC was sanctioned, one of TC’s contributing developers, Alex Pertsev, was arrested by Dutch authorities on allegations of money laundering. Apart from being a contributor to TC’s code, no concrete evidence has been disclosed yet that ties Pertsev to the laundered funds, nor have any official charges against him been made, yet he remains in pre-trial detention.

Following a recent hearing, he was remanded in custody until February 20, 2023, pending investigation as the court deemed him to be a flight risk. It remains to be seen how this case will turn out, but as one of the biggest crypto-related cases to reach a court of law, the outcome of it will set a precedent within the EU that could negatively affect the Bitcoin ecosystem in the region, particularly where financial privacy is concerned. This is the slippery slope that we find ourselves on, where the slow creep against financial privacy is another tactic that censors are using to protect their powers.

OFAC’s tentacles have also extended to Ethereum, which is gradually getting more centralized and less censorship resistant due to OFAC compliance as MEV-boost relays become more and more dominant. Following the long awaited merge upgrade in September that transitioned Ethereum to a proof-of-stake (PoS) consensus mechanism, data by Santiment indicates that 46.15% of Ethereum’s PoS nodes are controlled by just two addresses that belong to Coinbase and Lido. MEV-boost relays are also centralized entities that function as a bridge between block producers and block builders, giving all Ethereum PoS validators the option to outsource block production to third parties. As a result of this centralization, OFAC-compliant blocks came into existence, where it’s possible to censor certain transactions; like those from blacklisted TC addresses and any other sanctioned wallet addresses as designated by OFAC.

To put things in..

Related Content

- Bitcoin Now Accepted At South London’s Tooting Market

- Buy Solana Today And Get Rich in 2025?

- Bitcoin, Ethereum Technical Analysis: ETH Hits $2,000 for First Time Since May

- Bitcoin, Ethereum Technical Analysis: BTC, ETH Remain Near Multi-Month Lows Following Fed Rate Hike

- Bitcoin, Ethereum Technical Analysis: BTC Starts Weekend Trading Close to $25,000