- Leverage Advanced Trading Tools and Analytics

- Implement Strategic Dollar-Cost Averaging

- Diversify Your Bitcoin Investment Portfolio

- Stay Informed on Regulatory Changes

- Utilize Automated Trading Bots Wisely

- Embrace Long-Term Holding and HODLing

- Focus on Security and Safe Storage

Introduction

As we look ahead to 2025, understanding how to maximize your bitcoin profit potential becomes more critical than ever. With the increasing mainstream acceptance and technological advancements, Bitcoin offers exciting opportunities for both seasoned traders and newcomers. However, achieving optimal profits requires strategic planning, knowledge, and the right tools. In this article, I will share the **7 most powerful tips** to help you boost your bitcoin profit potential in 2025, based on current trends and best practices.

1. Leverage Advanced Trading Tools and Analytics

Using Real-Time Data for Better Decisions

In 2025, leveraging cutting-edge trading tools is essential. Platforms that offer real-time market data, technical analysis, and predictive analytics can help you identify optimal entry and exit points. For instance, tools like TradingView or Coinigy integrate advanced charting features that reveal market trends at a glance. Staying updated allows you to react swiftly to market movements and capitalize on bitcoinâs volatility.

These tools also include AI-powered insights that predict potential price swings based on historical data. By integrating these, you significantly improve your chances of maximizing bitcoin profit potential, avoiding impulsive decisions, and positioning yourself advantageously during market surges.

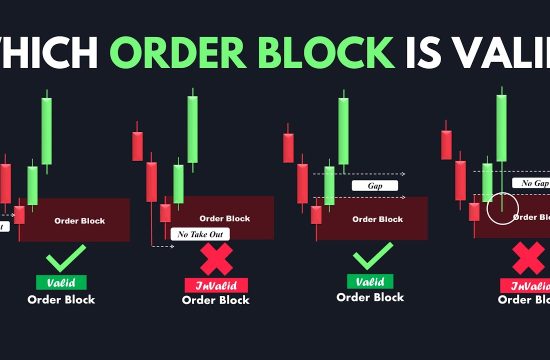

Utilizing Technical Analysis Effectively

Technical analysis remains a cornerstone of successful bitcoin trading. With the help of algorithms that identify patterns such as head and shoulders or RSI indicators, traders can anticipate future movements. In 2025, most platforms include machine learning tools that adapt to market changes, providing more accurate signals.

Remember, while tools are invaluable, combining them with your understanding of market sentiment will make your strategy more robust. Overcoming emotional reactions and sticking to data-driven decisions can dramatically enhance your bitcoin profit potential.

2. Implement Strategic Dollar-Cost Averaging

What Is Dollar-Cost Averaging and Why It Works

Dollar-cost averaging (DCA) is a proven strategy where you invest a fixed amount of money into Bitcoin at regular intervals, regardless of its price. This approach reduces the impact of market volatility, which remains high even in 2025. Instead of trying to predict market peaks, DCA spreads your purchase over time, ensuring you buy at various price points for balanced exposure.

Numerous studies, including recent 2025 analysis, confirm that DCA outperforms lump-sum investments during unpredictable markets. It minimizes the risk of FOMO and prevents emotional trading decisions that could diminish your bitcoin profit potential.

Creating an Effective DCA Plan

To maximize the benefits of DCA, set a consistent scheduleâweekly, bi-weekly, or monthlyâand stick to it. Automating your investments through trusted exchanges or custodians can help maintain discipline and consistency. Also, review your plan periodically; adjust your investment size or frequency as market conditions evolve.

In 2025, integrate DCA with other strategies like minor volatility trading or holding during bear markets. This balanced approach enhances your overall bitcoin profit potential while mitigating risks associated with mis-timing the market.

3. Diversify Your Bitcoin Investment Portfolio

Beyond Direct Bitcoin Holdings

While owning Bitcoin directly is fundamental, diversifying into related assets can significantly boost your bitcoin profit potential. Consider allocating a portion of your portfolio to Bitcoin ETFs, futures, or Bitcoin-related companies. Such diversification shields you from unforeseen regulatory or market risks affecting the direct Bitcoin market.

In 2025, many institutional investors are diversifying their crypto holdings through sophisticated instruments, which often lead to increased liquidity and stability in Bitcoin markets. This movement offers retail investors opportunities to position themselves strategically.

Balancing Risk and Reward

Diversification isn’t just about spreading investments; itâs about balancing risk and reward. For example, allocating funds to decentralized finance (DeFi) projects that use Bitcoin collateral may enhance profit potential while hedging against volatility. However, be cautiousâeach asset class carries unique risks.

Creating a diversified Bitcoin investment portfolio requires ongoing assessment. Keep an eye on emerging sectors within the crypto space, adjusting your allocations to optimize the bitcoin profit potential while managing downside risks effectively.

4. Stay Informed on Regulatory Changes

Understanding Its Impact on Profit Potential

Regulations significantly influence Bitcoinâs price and your profit potential. In 2025, governments worldwide are expected to introduce clearer frameworks, but changes can still create volatility. Staying informed about regulatory updates enables you to anticipate market shifts and adapt your strategies accordingly.

For example, if a major economy adopts favorable crypto regulations, it could surge Bitcoinâs demand. Conversely, stricter laws may temporarily depress prices. Keeping tabs on official announcements and policy debates helps you make timely investment decisions.

Tools and Resources for Tracking Regulations

Use reliable sources such as official government sites, industry news outlets, and social media channels of regulatory bodies. Subscribing to crypto-specific newsletters or joining online communities also helps keep you current. This ongoing awareness enhances your ability to capitalize on changes, maximizing your bitcoin profit potential.

5. Utilize Automated Trading Bots Wisely

Benefits of Automation in Crypto Trading

In 2025, automated trading bots have become indispensable for active traders aiming to maximize bitcoin profit potential. Bots execute trades based on preset parameters, eliminating emotional biases and enabling 24/7 market participation. They can capitalize on small price movements more efficiently than manual trading.

Platforms like 3Commas and HaasOnline offer sophisticated bots that can implement complex strategies, including arbitrage or scalping. When used correctly, these tools can significantly enhance your profitability, especially in volatile markets.

Best Practices for Automated Trading

However, automation isn’t foolproof. It’s crucial to understand the underlying algorithms and monitor bot performance regularly. Start with small investments to test strategies before scaling up. Keep your bot parameters aligned with current market conditions and news developments.

Combining automated trading with manual oversight ensures you can intervene during sudden market shifts, ultimately boosting your bitcoin profit potential without unnecessary risks.

6. Embrace Long-Term Holding and HODLing

Why HODLing Still Works in 2025

Despite the excitement around active trading, long-term holdingâcommonly known as HODLingâremains one of the most effective ways to maximize bitcoin profit potential. History shows that Bitcoin’s long-term trajectory is upward, and many experts expect continued growth in 2025.

Staying invested through market cycles allows your holdings to appreciate as adoption and institutional interest increase. HODLing also reduces transaction costs and minimizes the risks associated with short-term volatility.

Strategies to Enhance Long-Term Gains

Implementing dollar-cost averaging into your HODLing strategy can smooth out entry points and improve overall profit potential. Also, consider setting aside small portions of Bitcoin for periodic gains, while maintaining the core holding long-term. This approach balances liquidity needs with long-term growth potential.

Remember to keep security tight; store your holdings in reputable wallets or hardware devices. In 2025, a secure, hands-off approach can help you realize your full bitcoin profit potential with less stress.

7. Focus on Security and Safe Storage

Protecting Your Bitcoin Assets

The biggest risk to your profit potential is security breaches. In 2025, cyber threats continue evolving, making it essential to prioritize safe storage. Using hardware wallets like Ledger or Trezor provides cold storage, protecting your Bitcoin from hacking attempts.

Always enable two-factor authentication (2FA), use strong, unique passwords, and stay vigilant against phishing scams. Regularly update your security measures to keep your assets safe, ensuring your potential gains are protected.

Best Practices for Secure Storage

Avoid keeping large amounts of Bitcoin on exchanges; exchanges are attractive targets for hackers. Instead, move your holdings to secure wallets after purchase, especially if youâre not actively trading. Backup seed phrases securelyâpreferably offlineâso you can recover your assets if needed.

Ultimately, a proactive security strategy safeguards your investment, ensuring you realize your bitcoin profit potential without unnecessary loss.

Conclusion

Maximizing your bitcoin profit potential in 2025 requires a combination of smart strategies, tools, and security measures. From leveraging advanced analytics to long-term holding, each of these seven tips provides a solid foundation for thriving in todayâs dynamic market. Remember, staying informed, diversifying, and protecting your assets are crucial steps toward achieving your financial goals. By applying these insights, youâre better positioned to capitalize on Bitcoin’s growth and unlock its full profit potential in 2025 and beyond.

Frequently Asked Questions

1. How can I maximize bitcoin profit potential in 2025?

By utilizing advanced trading tools, diversifying your holdings, staying informed on regulations, and practicing secure storage, you can significantly enhance your bitcoin profit potential in 2025.

2. Is HODLing still a good strategy in 2025?

Yes, long-term holding or HODLing continues to be effective due to Bitcoinâs upward trajectory and increasing adoption. It helps maximize profit potential by riding out market volatility.

3. What are the risks associated with trading Bitcoin in 2025?

The main risks include market volatility, regulatory changes, security threats, and emotional decision-making. Using proper tools and secure practices can mitigate these risks.

4. What security measures should I take to protect my Bitcoin?

Use hardware wallets, enable 2FA, keep backups offline, and be cautious of phishing scams to safeguard your assets and prevent loss of your profit potential.

Related Content

- Bitcoin Technical Analysis: $38K Resistance Level Holds BTC Back

- Crypto Holders Are WRONG! The Fed is About to Blow Bitcoin Up!

- With Crumbling Economic Fundamentals, The Future Of Bitcoin Adoption In Norway Is Bright

- CRYPTO ALERT: MY BULL MARKET PREDICTION

- The Ultimate Guide to 10 Effective real time bitcoin trading Strategies for 2025